Best of #econtwitter - Week of October 25, 2020

Oct 25, 2020

Welcome readers old and new to this week’s edition of the Best of Econtwitter. Thanks to those sharing suggestions, over email or on Twitter @just_economics.

Paper summaries

Jon Mellon@jon_mellon

Just put up a research note on using weather as an instrumental variable.

tldr: all IV weather papers represent exclusion restriction violations for all other IV weather papers. I find 137 possible exclusion restriction violations

papers.ssrn.com

Rain, Rain, Go away: 137 potential exclusion-restriction violations for studies using weather as an instrumental variable by Jonathan Mellon :: SSRN

3:31 PM · Oct 20, 2020

94 Reposts · 388 Likes

Jon Mellon@jon_mellon

Or in meme form:

3:31 PM · Oct 20, 2020

37 Reposts · 133 Likes

^one of those things “everyone knows” but does nothing about. Pairs (un)happily with the paper discussed in last week’s newsletter on F-tests for weak IV

Eva Vivalt@evavivalt

"How Much Can We Generalize From Impact Evaluations" is out at JEEA!

Here's a thread with the key takeaways.... 1/

JEEA @JEEA_News

Forthcoming article by @evavivalt @UofT “How Much Can We Generalize From Impact Evaluations?”

@EEANews @OUPEconomics

https://t.co/F6zl6nh5vZ https://t.co/iGv6p8iXvP

8:51 PM · Oct 21, 2020

64 Reposts · 189 Likes

Ro'ee Levy@RoeeLevyZ

So excited and fortunate to have my JMP published! I conducted a field experiment to test what happens when people are exposed to more conservative or liberal news on Facebook. Details below. (1/N, my first Twitter thread :)

AEA Journals @AEAjournals

Forthcoming in the AER: "Social Media, News Consumption, and Polarization: Evidence from a Field Experiment" by Ro'ee Levy. https://t.co/xVlw31xZyV

8:57 PM · Oct 23, 2020

107 Reposts · 482 Likes

Jon Steinsson@JonSteinsson

We estimate the Phillips curve in the cross section. Huge advantage: Differences out shifting long-run expectations about inflation. Phillips curve looks 45 times steeper in the 80s using time-series variation, but only 1.8 time steeper using X-sectional variation 2/n

1:54 PM · Oct 20, 2020

6 Reposts · 14 Likes

Ethan Mollick@emollick

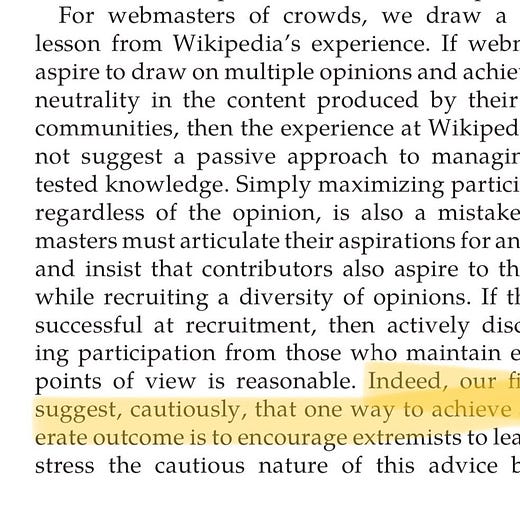

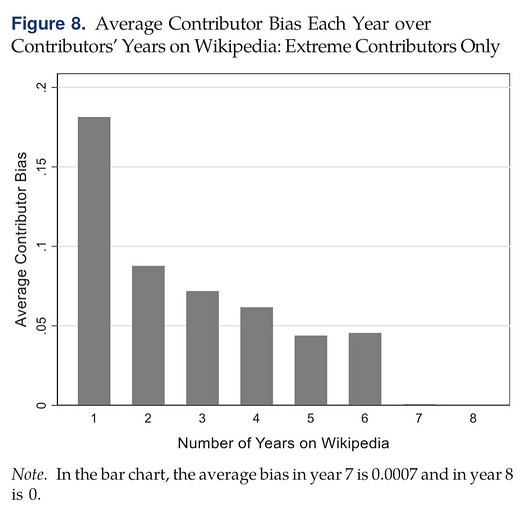

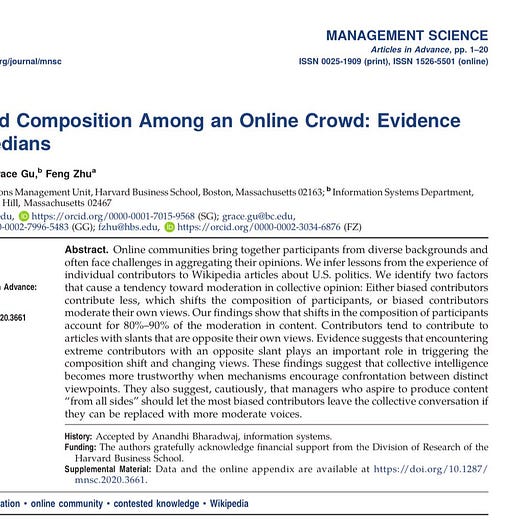

Vital paper that shows why Wikipedia achieves a moderate consensus on topics while Twitter & Facebook do not. Wikipedia does not filter what users see, so each article is exposed to different views. Then it subtly encourages extremists to leave, retaining moderate content & users

3:11 PM · Oct 18, 2020

144 Reposts · 479 Likes

Matt Clancy@mattsclancy

AFAIK, this is the only study on the productivity effects of full time work from home (with full geographic flexibility), with a rigorous causal identification strategy. Finds WFH increases productivity of patent examiners. Super relevant in the covid era as firms look to future.

Prithwiraj (Raj) Choudhury @prithwic

"Work-from-anywhere: The Productivity Effects of Geographic Flexibility" is now forthcoming at the Strategic Management Journal (@strategicmanagj ). Link to the paper: https://t.co/US0NToMZcQ https://t.co/zCRBz5A7HV

1:04 AM · Oct 22, 2020

11 Reposts · 37 Likes

Robert Dur@DurRobert

"How do economies perform under populist leaders?"

🔹"After 15 years, GDP per capita is more than 10% lower compared to a plausible non-populist counterfactual"

🔹"no decline in income inequality"

cepr.org/active/publica… by Manuel Funke, @MSchularick, and Christoph Trebesch

8:24 AM · Oct 24, 2020

239 Reposts · 722 Likes

Alexander Berger@albrgr

Noam Angrist @angrist_noam

🚨 New paper 🚨 in @WorldBank WP series: "How to Improve Education Outcomes Most Efficiently? A Comparison 150 interventions using the New Learning-Adjusted Years of Schooling Metric" w/ co-authors @DaveEvansPhD @deon_filmer @rglenner

Rogers @shwetlena

https://t.co/TNC9ueQzjI https://t.co/UcpSVU6DT7

12:29 PM · Oct 22, 2020

3 Reposts · 14 Likes

Ryan Israelsen@israelsen

In my forthcoming paper "Information Consumption and Asset Pricing" with Azi Ben-Rephael, Bruce Carlin, and @Zhi_Da, we show that firm- and macroeconomic announcements that convey systematic information generate a premium for stocks that experience information spillovers. (1/4)

Journal of Finance @JofFinance

Forthcoming soon: Ben-Rephael @RutgersBSchool, Carlin @Rice_Biz, @Zhi_Da @NDBusiness

@israelsen @MSUBroadCollege find that firm and macroeconomic announcements generate a return premium for firms that experience systematic information spillovers https://t.co/VpQnWUhUeo

8:06 PM · Oct 19, 2020

4 Reposts · 47 Likes

Jonathan A. Parker@ProfJAParker

(3/N) Our main point: micro-optimal is macro-stabilizing. By rebalancing to maintain age-appropriate asset allocations, Target Date Funds trade against excess returns in each asset class, stocks or bonds. We show a significant impact on equity funds flows and on stock *prices*

11:39 PM · Oct 22, 2020

8 Likes

Nick HK@nickchk

New paper out with Andrew Gill in Research in Higher Education:Semester Course Load and Student Performance. You can reduce time-to-degree by pushing more courses per term. But maybe students can't handle it and performance suffers? Not what we find!

link.springer.com

Semester Course Load and Student Performance

8:30 PM · Oct 18, 2020

10 Reposts · 55 Likes

Nageeb Ali@SNageebAli

This is a beautiful paper, with pretty pictures and crisp exposition. It's worth reading, and won't take you long.

Brief summary follows

1/7

AEA Journals @AEAjournals

Forthcoming in AER: Insights: "A Behavioral Characterization of the Likelihood Ratio Order" by Maximilian Mihm and Lucas Siga. https://t.co/OgkdAKLsyK

4:17 PM · Oct 22, 2020

4 Reposts · 23 Likes

Job market papers

Tell your students to tweet summary threads (and to write good papers!) and they’ll show up here :)

Jimbo Brand@jamesbrandecon

🚨🚨 Check out my JMP 🚨🚨

Have you noticed that there seem to be weird new varieties of everything now in supermarkets? My paper studies the effects of these "niche" products on consumer demand over time.

Highlights: 1/

static1.squarespace.com/static/5e5ac74…

static1.squarespace.com

5:53 PM · Oct 21, 2020

26 Reposts · 120 Likes

Matthew Wilson@MGWilsonEcon

The average passthrough of a 100bp monetary shock to general obligation muni yields is 22bp, but this effect is heterogeneous across U.S. states, due to illiquidity and risk differences.

8:31 PM · Oct 19, 2020

4 Likes

Colin McAuliffe@ColinJMcAuliffe

This is pretty wild. The rich not only tend to own more of asset classes that have higher returns, but even within asset classes they typically get higher returns than other people down the income ladder. This is esp true of real estate and interest bearing assets

Jennifer Doleac @jenniferdoleac

Inês Xavier

JMP: "Wealth Inequality in the US: the role of Heterogeneous Returns"

Website: https://t.co/sa3BW0O1t2 https://t.co/UXkHAbNFnl

7:38 PM · Oct 24, 2020

47 Reposts · 145 Likes

^the author’s account here

Good discussion

Rachael Meager@economeager

It's practice job market talk season for grad students! A little known fact about job talks is they should be aimed at second year undergraduates, because that is how smart the average faculty member is when they are sitting in a comfortable chair with a phone in their pocket.

1:33 PM · Oct 22, 2020

25 Reposts · 361 Likes

^thread, recommended — and not just for JMCs; and check out the discussion too

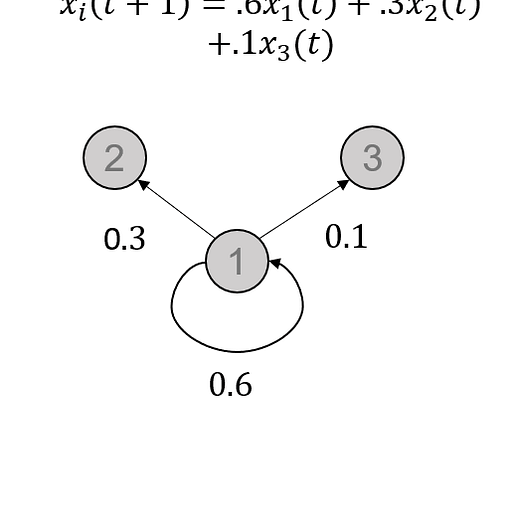

Ben Golub@ben_golub

A thread on what we can learn about polarization of opinions from a simple behavioral network model.

Remember the DeGroot model? It says you decide what to think tomorrow by taking an average of what you and your friends think today.

Examples:

1/

4:51 PM · Oct 22, 2020

120 Reposts · 386 Likes

Sharan Banerjee@sharanbanerjee

Hi #EconTwitter, do you all have general tips for graduate students who are transitioning from full-time coursework to full-time research (such as rising 3rd years) in terms of maintaining workflow, scheduling, keeping our sanity intact during this transition phase etc.?

3:18 AM · Oct 20, 2020

22 Reposts · 105 Likes

Arpit Gupta@arpitrage

@leah_boustan @DouthatNYT So the evidence does not seem so mixed. I support immigration, but these points would suggests the economy shifted (maybe in long run) to a higher-wage, higher productivity equilibrium with more manufacturing, more productive agriculture, and less low value add mining.

1:53 AM · Oct 25, 2020

5 Likes

Professional navel-gazing

Dina D. Pomeranz@DinaPomeranz

Are macroeconomics and the rest of economics two separate disciplines?

The image of the Twitter networks may suggest so:

https://t.co/l6XPUch9nx

6:22 PM · Oct 25, 2020

103 Reposts · 442 Likes

Maksym Polyakov@MaksymPolyakov

Here you go...

Highest %% of authors from Africa, Asia, South America.

Also highest diversity (Shannon index) by countries and institutions.

(data 2007-2017)

Richard Tol @RichardTol

@geo_diverse Looking forward to it.

I bet we publish more from Africa, South Asia and South America than most other journals.

9:50 AM · Oct 20, 2020

7 Reposts · 19 Likes