Best of #econtwitter - Week of October 3, 2021 [1/2]

Oct 04, 2021

Welcome readers old and new to this week’s edition of Best of Econtwitter. Thanks to those sharing suggestions, over email or on Twitter @just_economics.

This is part one of two, this week. Part two is here.

Paper summary threads

Elisa Jacome@elisajacome

Most long-run estimates of U.S. intergenerational mobility only include white men. What does mobility over the 20th century look like when we include non-whites *and* women?

A thread on my new paper with @ikuziemko and @snaidunl

nber.org

Mobility for All: Representative Intergenerational Mobility Estimates over the 20th Century

3:19 PM · Sep 27, 2021

113 Reposts · 428 Likes

Drew Stommes@StommesDrew

Retrospective power analyses demonstrate that most studies were underpowered to detect all but large effect sizes. We conclude that many published findings using the RD design are exaggerated if not altogether spurious. [4/4]

11:27 AM · Sep 30, 2021

4 Reposts · 43 Likes

Drew Stommes@StommesDrew

We show that the literature demonstrates some pathological behavior consistent with selective reporting of findings. The figure below demonstrates that findings cluster just at or just above the t-statistic threshold of 1.96 (i.e. a p-value of less than or equal to 0.05). [2/4]

11:27 AM · Sep 30, 2021

7 Reposts · 37 Likes

Tatyana Deryugina@TDeryugina

🚨New working paper alert🚨

@davidmolitor and I present an overview of “The Causal Effects of Place on Health and Longevity”

secureservercdn.net/104.238.71.33/…

secureservercdn.net

11:10 AM · Sep 27, 2021

17 Reposts · 63 Likes

KrajbichLab@KrajbichLab

New paper with @caryfrydman in Management Science. Summary: Slow choices generally signal uncertainty. So, when people see others choosing slowly, they tend to ignore those choices and follow their own private information. This helps them to avoid “herding” on bad choices. 1/5

3:45 PM · Sep 29, 2021

31 Reposts · 135 Likes

Arshia Hashemi@ArshiaHashemi

New bite-sized working paper, joint with my @UChicago peers: Ivan Kirov & James Traina.

papers.ssrn.com/sol3/papers.cf…

Our main point: production approach markup estimators often measure input wedges, rather than markups.

Thread 🧵

papers.ssrn.com

Production Approach Markup Estimators Often Measure Input Wedges

4:58 PM · Oct 1, 2021

6 Reposts · 27 Likes

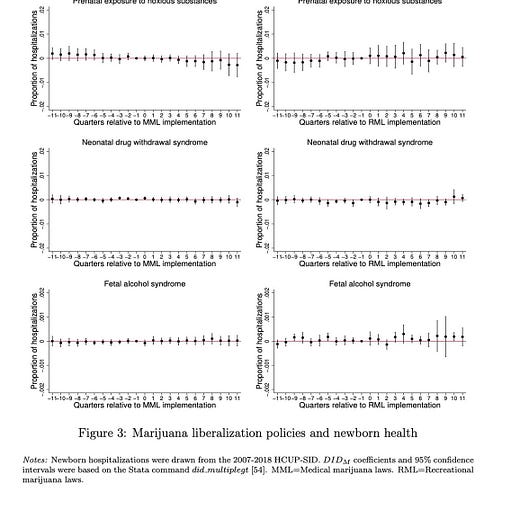

John B. Holbein@JohnHolbein1

Does marijuana legalization harm babies?

Naw.

"our findings implied modest or no adverse effects of marijuana liberalization policies on the array of perinatal outcomes considered."

nber.org/papers/w29296

1:23 PM · Sep 27, 2021

2 Reposts · 11 Likes

Javier Bianchi@JavierBianchi7

Thrilled to see our paper coming out with @SakiBigio

Standard macro models assume the central bank controls a single interest rate that guides all saving/borrowing decisions of all agents.

But the target rate for the Fed and many central banks is the interbank market rate.

Econometrica @ecmaEditors

The plumbing of monetary policy matters for macro. We develop a model of the transmission and implementation of monetary policy and show that how a central bank implements the target for the interbank market rate affects credit and economic activity https://t.co/jl9651Njs9 https://t.co/eQlqJzGDNB

2:51 PM · Oct 1, 2021

33 Reposts · 244 Likes

Caleb Watney@calebwatney

Despite a massive increase in demand for higher ed over the last 30 years, "supply" at elite colleges has stayed basically the same.

When ranked on SAT scores, colleges in the 1-98% range have met demand while elite colleges' share of total enrollment has been shrinking.

8:03 PM · Sep 27, 2021

2 Reposts · 33 Likes

Matt Marx@marxmatt

you've heard me talk about this patent-to-paper citation dataset (relianceonscience.org), but the accompanying article is now available open-access📣onlinelibrary.wiley.com/doi/10.1111/je…. not-so-brief 🧵of why the paper might be worth reading even if you already have the data... 1/

2:20 PM · Sep 29, 2021

18 Reposts · 77 Likes

Public goods

Tatyana Deryugina@TDeryugina

I'm going to write a blog post on the pros and cons that economists (PhD students, post-docs & faculty) considering joining Twitter should know about. #EconTwitter, what are your biggest pros and cons?

(The ability to pose questions like these will clearly be listed as a pro!)

12:23 PM · Sep 27, 2021

31 Reposts · 175 Likes

^replies, with the results discussed here and blog post here

Frank Schilbach@FrankSchilbach

Excited & slightly terrified that all materials & videos of my MIT undergrad psychology & economics course (aka behavioral econ) from Spring 2020 are online on OCW!

As an undergrad, I loved browsing OCW classes. I hope this one will be useful for others!

ocw.mit.edu

Psychology and Economics

9:19 PM · Sep 28, 2021

238 Reposts · 937 Likes

Thomas Drechsel@td_econ

A new data base of banking-crisis interventions since the 13th century across 100+ countries!

See working paper by Metrick and Schmelzing:

nber.org/papers/w29281#… #econtwitter

nber.org

Banking-Crisis Interventions, 1257-2019

1:58 PM · Sep 27, 2021

59 Reposts · 225 Likes

Interesting discussions

A lot of macro this week: inflation expectations, exchange rate regimes, more inflation expectations

César A. Hidalgo@cesifoti

After advising PhD & Master students for over a decade, there is one thing I find most students need to unlearn: the half-ass work mentality acquired during years of tests and homework. Let me explain (thread 🧵). 1/N #AcademicTwitter

1:19 PM · Sep 12, 2021

4.91K Reposts · 14.1K Likes

Shengwu Li@ShengwuLi

The discussion around this thread suggests that many economists use “utility” in senses other than what the theory supports.

Economics is not based on the idea that people maximize life satisfaction, or maximize pleasure minus pain.

vNM utility is not hedonic utility!

Itai Sher @itaisher

I don’t like phrases of the form “agents derive utility from the common good” or “agents derive utility from the well-being of others.”

Better replacements are “agents care about the common good” or “agents care about the well-being of others”

4:06 PM · Oct 2, 2021

11 Reposts · 126 Likes

Alex Tabarrok@ATabarrok

This is completely wrong but in an interesting way. See if your principles or intermediate micro students can answer. #EconTwitter

Joe Weisenthal @TheStalwart

Psaki seems right to me. If a company had the power to raise prices at a higher tax level, why wouldn't it raise prices now at current levels? Either the pricing power exists or it doesn't. https://t.co/OYXOLz5uXT

11:26 PM · Sep 29, 2021

46 Reposts · 355 Likes