Best of #econtwitter - Week of June 5, 2022 [3/3]

Jun 06, 2022

Welcome readers old and new to this week’s edition of Best of Econtwitter. Thanks to those sharing suggestions, over email or on Twitter @just_economics.

This is part three of three.

Paper summaries

Matt Clancy@mattsclancy

New post! Featuring evidence from:

Nobel prizes!

Turnover among top cited papers!

Growth of topics under study!

Citations to recent work by papers and patents!

mattsclancy.substack.com

Science is getting harder

1:07 PM · Jun 1, 2022

43 Reposts · 144 Likes

Abby Sussman@abbysussman

**Now out @JofFinance** with the best co-authors @AlexChinco @SamHartzmark

doi.org/10.1111/jofi.1…

We question the commonly accepted view in finance that asset prices move because of investors’ beliefs about “risk factors”. A (delayed) thread in layman’s terms. (1/n)

1:36 PM · Jun 2, 2022

21 Reposts · 102 Likes

Abby Sussman@abbysussman

TLDR: To learn what motivates investors’ decisions, ask them! We propose a survey based framework and find that investors care about means and volatility. No evidence they care about risk-factor correlations (which are a big deal in existing finance lit). (2/n)

1:37 PM · Jun 2, 2022

2 Reposts · 11 Likes

^some interesting discussion on this here on the role of tail risk, and here on as-if assumptions

Fatih Guvenen@fatihguvenen

(2/n) Basically, in official data, between 1982 and 2016 US direct investment abroad earned an average return of 11.7% versus 4.6% for foreigners' FDI in the US. An FDI "premium" of 7.1%. This is well known.

See "unadjusted" series in left panel.

7:08 PM · Jun 1, 2022

6 Likes

Fatih Guvenen@fatihguvenen

(3/n) We show that US multinationals underreport profits in the US and overreport abroad, inflating returns abroad and generating part of this measured premium.

Once corrected for this, adjusted USDIA return falls to 7.3% and premium shrinks to 2.7% (from 7.1%)

7:08 PM · Jun 1, 2022

8 Likes

^another thread on the paper

Florian Ederer@florianederer

I am constantly amazed by how good @ATabarrok, @tylercowen, and @MargRev are at conveying the intuition and results of recent economics research to a non-expert audience.

Their explanation and discussion of my recent paper with @WeichengM (@YaleEconomics) is fantastic.

Alex Tabarrok @ATabarrok

Fact Checking Increases Fake News! https://t.co/IndfgQXPx3

5:52 PM · Jun 1, 2022

4 Reposts · 81 Likes

Journal of Public Economics@JPubEcon

Summer youth employment programs are scalable, replicable, and consistently reduce crime. Biggest effects for youth at higher risk of crime and other costly outcomes—serving this group can maximize social benefits and increase equity.

7:57 PM · May 31, 2022

5 Reposts · 9 Likes

Lionel Page@page_eco

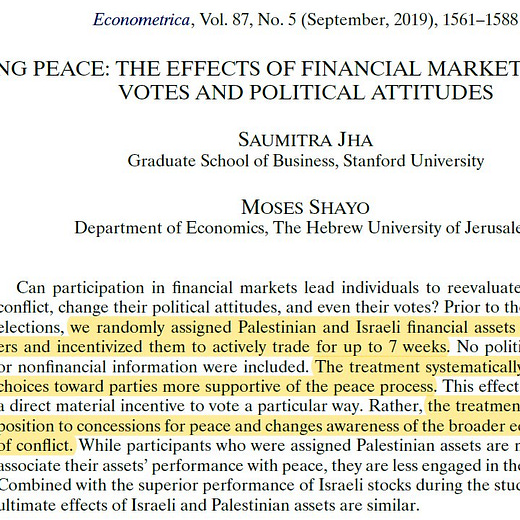

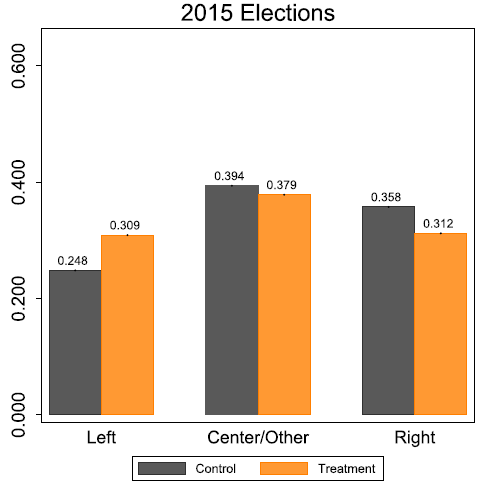

Does market capitalism foster conflicts or tend to reduce them?

This interesting study got participants in Israel to trade financial assets for 7 weeks. It increased their preference for peace solutions, as they experienced the economic costs of conflict.

onlinelibrary.wiley.com/doi/abs/10.398…

1:16 PM · Jun 2, 2022

14 Reposts · 44 Likes

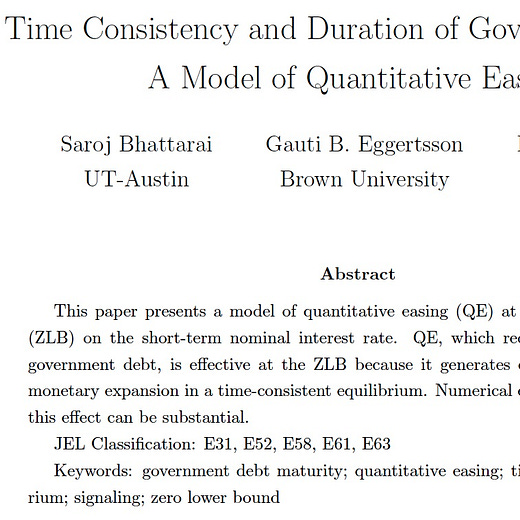

Gauti Eggertsson 🇺🇦@GautiEggertsson

Bernanke famously quipped that “The problem with Quantitative Easing (QE) is that it works in practice but not in theory”.

My paper with Bhattarai and Gafarov on how QE can work in theory is forthcoming in the Review of Economic Studies. A thread:

10:30 AM · Jun 3, 2022

176 Reposts · 907 Likes

John Kroencke@johnkroencke

Rent control caused property values to fall by 6-7%, for an aggregate loss of $1.6 billion

The tenants who gained the most from rent control had higher incomes and were more likely to be white

The owners who lost the most had lower incomes and were more likely to be minorities.

9:37 AM · May 30, 2022

5 Likes

^St. Paul

Paul Novosad@paulnovosad

"Men who lose access to Medicaid eligibility are 14% more likely to be incarcerated in the subsequent two years relative to a matched comparison group. The effects are entirely driven by men with mental health histories."

by @elisajacome

elisajacome.github.io/Jacome/Jacome_…

2:48 PM · Jun 3, 2022

109 Reposts · 356 Likes

More: Australian monetary policy; ethnic fractionalization measures; PEAD on macro announcement days vs not

Interesting discussions

Peter Hull@instrumenthull

In papers w/many regressions we use up many greek letters for control coefs/errors that aren't of interest. It's often tough to ensure letters aren't used for different things &sometimes you run out

This could be helped if we switch to functional notation like \beta = reg(y,x;w)

3:22 PM · Jun 1, 2022

8 Reposts · 132 Likes

Peter Hull@instrumenthull

Of course reg(y,x;w), iv(y,x=z;w), etc are much closer to how we actually define + run regressions/IVs/etc in Stata/R/etc. Seems like bringing notation closer to that might help clarify what a paper is actually doing to the data. The hard part is just agreeing on a common syntax

3:26 PM · Jun 1, 2022

38 Likes

Shengwu Li@ShengwuLi

Why is it so bad when health/nutrition studies make causal claims by controlling for observables (CfO)?

The problem is that CfO just doesn't give enough respect to human decision-making.

4:22 PM · Jun 2, 2022

22 Reposts · 160 Likes

^re “coffee is helping us live forever again in a new study featured in NYT” (Emily Oster)

Anup Malani@anup_malani

Economics PhD programs should have a required descriptive statistics class.

Not for learning to make pretty graphs. No theory.

Just to learn facts that could get students’ creative juices thinking about big problems.

Also so we don’t lose sight of the forest for the trees.

12:48 PM · Jun 4, 2022

140 Reposts · 1.31K Likes

John Cochrane@JohnHCochrane

@anup_malani Why just Economics PhDs? "Basic quantification" should be a required class for undergraduates! The size and age of the universe, economic growth and development (levels, please), climate, and social realities, a tiny bit of simple numeracy would go a long way. Write the book!

1:29 PM · Jun 4, 2022

6 Reposts · 87 Likes