Best of #econtwitter - Week of January 9, 2022 [3/3]

Jan 10, 2022

Welcome readers old and new to this week’s edition of Best of Econtwitter. Thanks to those sharing suggestions, over email or on Twitter @just_economics.

This is part three of three (hopefully a rare three-part issue). Part one is here; part two is here.

Paper summary threads

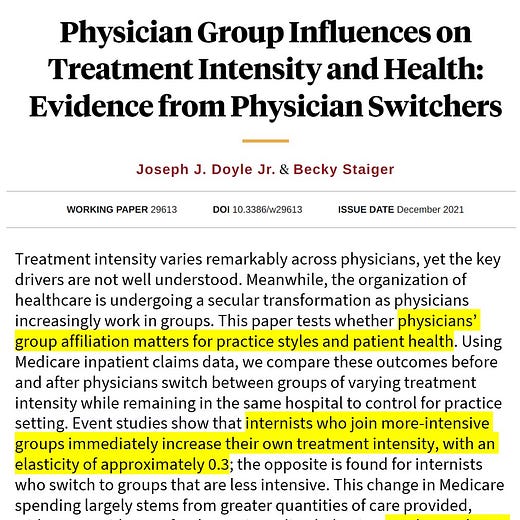

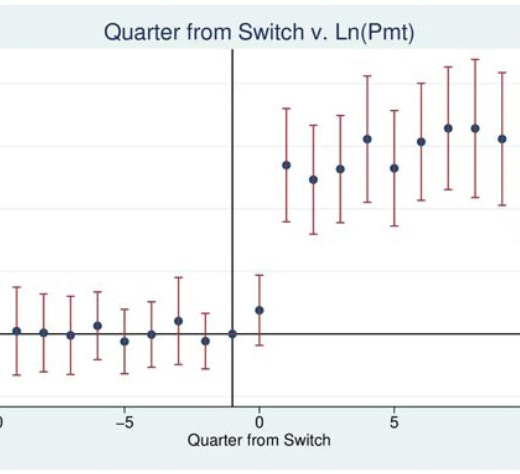

David Molitor@davidmolitor

Physicians who switch to a more intensive group practice immediately increase the amount and cost of care they provide to patients, with no detectable change in readmissions or mortality outcomes, according to new research by Joe Doyle & Becky Staiger. nber.org/papers/w29613

6:25 PM · Jan 3, 2022

13 Reposts · 71 Likes

Patricia Kanngiesser@PatKanngiesser

🎉Out this week:

Children across societies enforce conventional norms but in culturally variable ways pnas.org/content/119/1/…

@PNASNews

with @EstherHerrmann2 @DBMHaun and the twitterless Marie Schäfer, Henriette Zeidler, & Michael Tomasello

1/n

pnas.org

Children across societies enforce conventional norms but in culturally variable ways

4:45 PM · Jan 3, 2022

32 Reposts · 86 Likes

Jacob Wallace@jwswallace

🚨 Excited to share a new paper in @AnnalsofIM 🚨

Our goal: LaLonde (1986) but in context of assessing heath plans...

We ask: How well measures of plan performance from observational data match RCT-like evidence?

Results were concerning. A 🧵... (1/5)

acpjournals.org/doi/10.7326/M2…

2:43 PM · Jan 4, 2022

53 Reposts · 156 Likes

Jacob Wallace@jwswallace

We studied a unique context in which 2/3 of Medicaid enrollees were randomized to 1 of 5 plans ("RCT-like" evid.) and 1/3 selected a plan ("observational" evid.).

Using risk adjustment methods on observational sample, we generally could not recover the RCT-like estimates. (2/5)

2:43 PM · Jan 4, 2022

3 Reposts · 11 Likes

Alex MacKay@_amackay

New working paper: Mark Egan, Hanbin Yang, and I use a comprehensive dataset of 401(k) retirement plans from 2009-2019 to examine heterogeneity in investment behavior. For example, 44 percent of assets are allocated to U.S. equity funds, but this varies widely across plans... 1/5

NBER @nberpubs

An analysis of investment behavior using comprehensive data on 401(k) plans documents substantial differences in investment behavior, which is attributable to beliefs and risk aversion, from Mark L. Egan, @_amackay, and Hanbin Yang https://t.co/976W2i4IJ3 https://t.co/K4aSPj09vt

2:02 PM · Jan 3, 2022

2 Reposts · 12 Likes

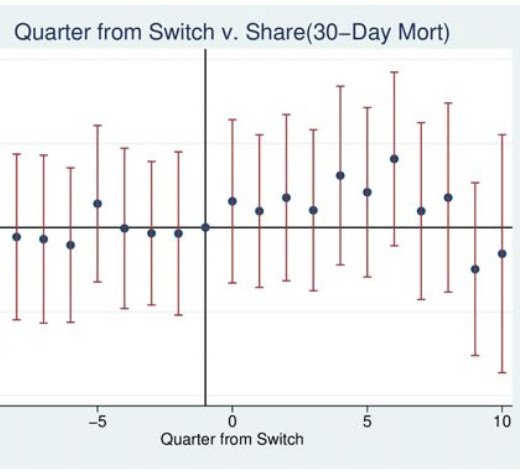

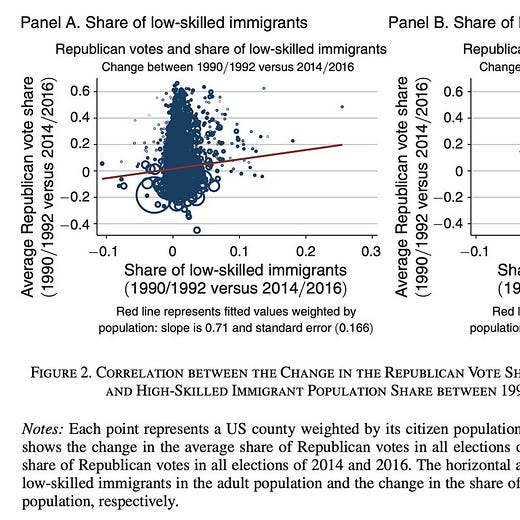

Michael Clemens@m_clem

In the US, more educated immigrants raise local vote share for Democrats, less educated immigrants reduce it.

Halving immigration overall would have hurt Democrats in 2016, since former effect exceeds latter

New research by Mayda, Peri, and Steingress—> doi.org/10.1257/app.20…

3:25 PM · Jan 3, 2022

25 Reposts · 81 Likes

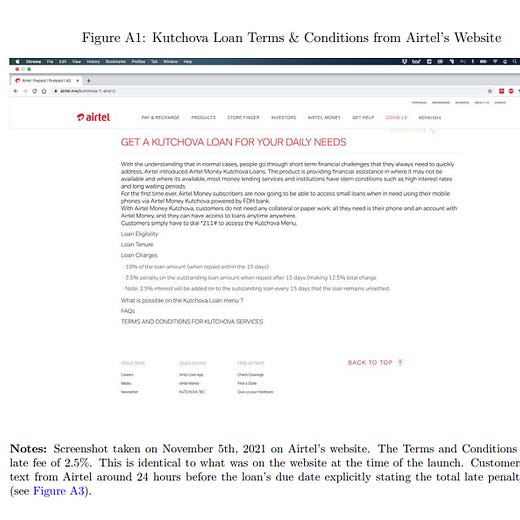

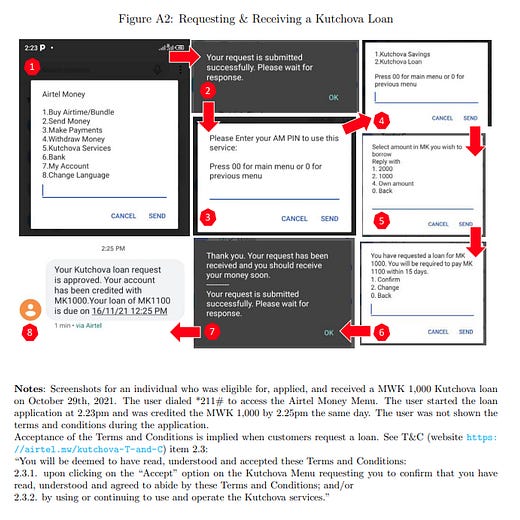

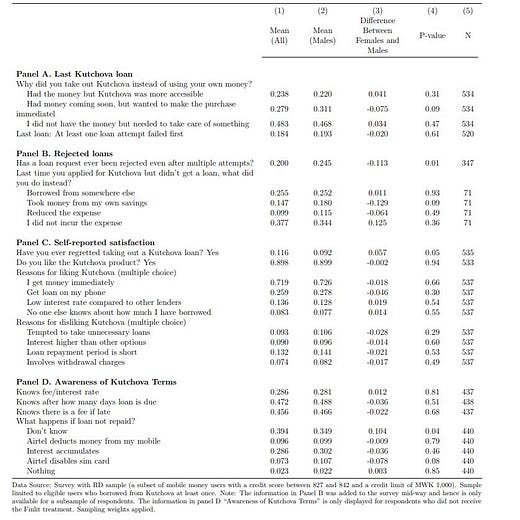

Saksham Khosla@khoslasaksham

New research shows that short-term high-interest digital credit in Malawi had no significant impact on well-being. Notably, a financial literacy intervention intending to increase awareness about risks and costs actually increased (!) demand and repayment, increasing overall risk

4:47 AM · Jan 10, 2022

1 Repost · 4 Likes

Ben Moll@ben_moll

How can we map predictions of such notional unified consumption models to the real world? In particular predictions about marginal propensities to consume (MPCs)?

This is the question we tackle in a short paper with David Laibson and Peter Maxted

benjaminmoll.com/MPX/

2/

10:37 AM · Jan 9, 2022

3 Reposts · 37 Likes

Caitlin Knowles Myers@Caitlin_K_Myers

Just got to discuss a compelling new paper on the downstream effects of increasing abortion access from @ninarbrooks and @ZoharTom at #ASSA2022. An (event study) picture is probably worth 1,000 (or 280) words:

11:41 PM · Jan 8, 2022

3 Reposts · 20 Likes

More: patent enforcement and litigation; cyclical labor market reallocation; air quality and elections; “green patents”; optimal tax theory; intersectional inequalities in science; raising p=.05?; IO and MP; macro SVAR; monetary policy and sovereign default risk; measuring preferences for public goods

Interesting discussions

Jose M. Fernandez@UofLEcon

Relevant information for job market candidates. (Maybe I should be on the market?) #ASSA2022

8:44 PM · Jan 8, 2022

25 Reposts · 108 Likes

Natalia Emanuel@NataliaHEmanuel

A handful of thoughts on flyouts for job market candidates.

One of three 🧵s – threads 2 and 3 have tips specific to in-person flyouts and remote flyouts

#EconTwitter #EconJobMarket #AcademicTwitter #AcademicChatter

2:46 AM · Jan 9, 2022

5 Reposts · 44 Likes

^part 2 on remote flyouts; part 3 on in-person

Emma Harrington@emma_k_h

Great thread about how the credibility revolution widened economics’ scope by introducing tools that didn’t depend on economic theory. Sometimes I narrowly feel that requiring clean causality limits the set of questions but often forget just how many domains economics now covers!

scott cunningham @causalinf

That Card speech on design vs model based approach to causal inference in the history of empirical micro is all I can think about this last week. His discussion of the role of the "model" in these three broad approaches -- I can't get it out of my head. 1/

5:52 PM · Jan 9, 2022

9 Reposts · 60 Likes

Arpit Gupta@arpitrage

Will the ASSA be virtual or in person next year (2023)?

9:02 PM · Jan 8, 2022

5 Likes

^poll, click through to see results (n=190)