Best of #econtwitter - Week of February 5, 2023: paper summaries

Feb 08, 2023

Welcome readers old and new to this week’s edition of Best of Econtwitter. Please submit suggestions — very much including your own work! — over email or on Twitter @just_economics.

Idiosyncratic favorites

Kevin Rinz@kevinrinz

🚨 New *short* working paper w/ @john_voorheis 🚨

Re-examining Regional Income Convergence: A Distributional Approach

Comes with new data for you to play with!

Paper: kevinrinz.github.io/convergence.pdf

Non-technical summary: kevinrinz.github.io/convergence_su…

Data: kevinrinz.github.io/data.html

4:18 PM · Feb 2, 2023

20 Reposts · 65 Likes

Kevin Rinz@kevinrinz

Prior studies often consider the relationship between mean state income in some base year and income growth over some subsequent period. Extending this approach across the distribution shows top percentiles actually *diverging* while the rest of the distribution converges slowly

4:32 PM · Feb 2, 2023

1 Repost · 14 Likes

James Traina@EconTraina

🚨 Public-firm profit rates have fallen to *half* their 1980 values 🚨, which explains why financial market rates fell despite rising/steady *aggregate* profit rates.

papers.ssrn.com/sol3/papers.cf…

New draft with @ASollaci & @CarterDavisFin, & outstanding support from @TonBobrov...🧵

papers.ssrn.com

Profit Puzzles

4:12 PM · Jan 31, 2023

14 Reposts · 51 Likes

James Traina@EconTraina

Nonfinancial domestic private-firm profit rates have doubled!

So if we have high market power, it's probably in private firms.

4:12 PM · Jan 31, 2023

1 Repost · 6 Likes

Rachel Glennerster@rglenner

In ruins of war, donors rush in with aid. With standard infrastructure destroyed, they often give money direct to communities through CDD. Does it make lives better in the long run? Our evidence suggests it does--real econ differences 11 years on from RCT. Now in @EJ_RES 1/n

10:45 AM · Jan 31, 2023

52 Reposts · 191 Likes

Anthony Lee Zhang@AnthonyLeeZhang

Thanks to @luluywang's JMP I now think there is a simple way to fix the broken US credit card industry

Just require, on every transaction, interchange fees to be shown separately from base prices, the same way taxes, tips, hospitality supplements, etc. are shown

7:28 PM · Feb 2, 2023

3 Reposts · 39 Likes

Paper summaries

Ryan Decker@UpdatedPriors

1/N New note with @jac0bmwilliams on measuring industry concentration in Compustat data (i.e., just publicly traded firms). We find Compustat isn't well suited for this particular task, consistent w/ prior literature for on earlier years/fewer industries.

federalreserve.gov

A note on industry concentration measurement

10:57 PM · Feb 3, 2023

34 Reposts · 128 Likes

Stephan Luck@StephanLuck

Most C&I lending in the US is floating rate with the reference being LIBOR. LIBOR, however, is being replaced with the risk-free rate, SOFR. Here is why it matters for credit supply and why you should expect even more massive line draws in the next banking crisis. 1/N 🚨🚨🚨

1:52 PM · Feb 4, 2023

24 Reposts · 95 Likes

Mike Mueller-Smith 🏳️🌈@Econ_Mike

🚨🚨🚨WP Alert🚨🚨🚨

“Criminal court fees, earnings, and expenditures: A multi-state RD analysis of survey and administrative data,” with @carldotac and @ElizLuh. @UM_CJARS.

A thread 1/16

4:27 PM · Jan 30, 2023

24 Reposts · 72 Likes

Andrey Fradkin 🇺🇦@AndreyFradkin

1/ Excited to release our NBER working paper on Amazon's preferencing of its own products in search results. This is a short paper that uses a new tool, a browser extension, to measure real Amazon users' search results and behavior. Joint w/ Chiara Farronato and @_amackay

7:27 PM · Jan 30, 2023

49 Reposts · 213 Likes

Timothy Layton@timothyjlayton

Another new administrative burdens NBER WP this week!

This time on how they impede take-up of subsidized health insurance, joint with @ProfKMEricson @onceuponA @asacarny

nber.org

Reducing Administrative Barriers Increases Take-up of Subsidized Health Insurance Coverage: Evidence from a Field Experiment

3:24 PM · Jan 30, 2023

11 Reposts · 31 Likes

^separate thread on policy implications

Jūra Liaukonytė@JuraWho

There is this paper that I love that is very well-known in Finance but not so much in IO: Hoberg and Phillips (2016).

It estimates time-variant product space boundaries from text descriptions in 10-Ks of publicly traded companies. Neat visualization from Bruno Pellegrino's JMP:

3:21 PM · Feb 2, 2023

7 Reposts · 95 Likes

Lukas Freund@_LukasFreund_

Super interesting to see evidence on diffusion of novel technologies across (i) geographies and (ii) jobs with different skill levels...

... in this paper by @I_Am_NickBloom, Hassan, @AakashKalyani, Lerner, @tahoun100.

🔗nber.org/system/files/w…

3:27 PM · Jan 31, 2023

14 Reposts · 80 Likes

Daniel Ershov@ershov_daniel

1/7 I've made this pt before, but the main takeaway from this paper is not clear at all, & it's certainly NOT "judges listen to what random people write on Wikipedia!!"...

Ethan Mollick @emollick

Want to shape the law? Write a Wikipedia article.

Clever paper created detailed Wikipedia articles on 77 Irish Supreme Court cases, and finds those cases are more likely to be cited by lower courts... who also echo the language of the Wikipedia articles! https://t.co/nH1pYZvsDQ https://t.co/TEk2bdjJ3J

11:11 AM · Jan 30, 2023

10 Reposts · 36 Likes

Daniel Ershov@ershov_daniel

2/7 Why? The authors had GRADUATE LAW STUDENTS to write the wiki articles about the cases - so it's NOT really USER generated info - it's actually EXPERT generated info...

11:12 AM · Jan 30, 2023

1 Repost · 17 Likes

Tobias Klein@kleintob

At which level should one cluster standard errors? What's good empirical practice? Have you ever heard about placebo regressions in this context? Here is a very useful guide that was recently published in the JoE doi.org/10.1016/j.jeco…. 🧵 with a short summary. #EconTwitter 1/9

doi.org

Redirecting

9:22 AM · Jan 31, 2023

89 Reposts · 369 Likes

Susan Athey@Susan_Athey

Synthetic difference-in-differences, in Stata! Check out our article describing the package. Makes nice graphs illustrating time trends and unit weights. Comments welcome! arxiv.org/pdf/2301.11859…

6:53 AM · Feb 3, 2023

416 Reposts · 1.75K Likes

Samir Khan@stats_samir

How does dropping units with small estimated propensity scores affect downstream inferences? When is it justified?

See our new work with @jugander that revisits the foundations of sample trimming:

arxiv.org/abs/2210.10171 (1/9)

7:47 PM · Jan 30, 2023

7 Reposts · 40 Likes

Lionel Page@page_eco

Our paper on game theory and how professional tennis players serve is now forthcoming at Quantitative Economics!

We find that tennis players are really good at playing mixed Nash equilibrium strategies on their serves, but not perfect. 🧵

2:12 PM · Feb 3, 2023

283 Reposts · 1.7K Likes

Michèle Nuijten @MicheleNuijten@sciences.social@MicheleNuijten

We compared statistical inconsistencies in 2 journals that implemented #statcheck in peer review and 2 matched controls, before and after statcheck implementation:

- Psych Science (🤖) vs. Journal of Exp Psych: General

- Journal of Exp Soc Psych (🤖) vs. JPSP

10:12 AM · Jan 31, 2023

1 Repost · 2 Likes

Michèle Nuijten @MicheleNuijten@sciences.social@MicheleNuijten

Preregistered multilevel logistic regression analyses found a significant interaction effect of journal_type*time in the expected direction: a steeper decline in (decision) inconsistencies in statcheck journals than matched controls.

10:12 AM · Jan 31, 2023

3 Likes

Evelyn Smith@evelyn_a_smith

Black taxpayers are 3-5 times more likely to be audited than non-Black taxpayers. The disparity isn't explained by gaps in dollars of underreporting. What's happening here?

(with @hselzayn, Tom Hertz, @arunramesh_, Robin Fisher, @DanHo1, & @jacobsgoldin)

siepr.stanford.edu/publications/m…

8:42 PM · Jan 30, 2023

40 Reposts · 109 Likes

Namrata Narain@nummoose

In anticipation of the FOMC meeting tomorrow, @ksangani8 and I have an interesting result to share!

Market volatility is 3x higher during Chair Powell’s conferences compared to his predecessors. This difference set in at the advent of the Covid-19 pandemic. #EconTwitter

9:02 PM · Jan 31, 2023

9 Reposts · 49 Likes

Kunal Sangani@ksangani8

How will markets react to the FOMC conference tmrw? While the Chair’s press conference typically reinforces the market’s read of the FOMC statement, @nummoose and I find a break in the pattern recently: Chair Powell’s latest conferences tend to go the other way. 1/ #econtwitter

9:02 PM · Jan 31, 2023

12 Reposts · 72 Likes

Allison Luedtke 🇺🇦@LuedtkeAllison

What is the velocity of money?

In our new 🚨working paper🚨 @CarolinaMttssn, @franktakes, and I use new large-scale network data to find out. We find that money changes hands at different speeds for different people.

🧵 Thread on how we did it below. (1/11)

3:09 PM · Jan 30, 2023

32 Reposts · 117 Likes

Alp Simsek@alpsimsek_econ

1/

Inflation is declining. Economic activity is strong

Smooth landing looks plausible

Fed's Covid policy response looks "better"—if not ideal

Seems like a good time to revisit our paper where we analyze OPTIMAL policy with temporary supply shocks

Link: dropbox.com/s/x2i8a1o26ql6…

3:05 PM · Feb 5, 2023

35 Reposts · 209 Likes

Moritz Schularick@MSchularick

2/N We show that historically central banks expanded their balance sheets to cushion fiscal pressures during wars. Over time, lender of last resort (LOLR) operations during financial crises became the main driver and are used pretty much systematically during crises today

1:09 PM · Feb 5, 2023

2 Reposts · 22 Likes

Philip Hoxie 🇺🇸🇺🇦🇹🇼@phoxie58

🧵🚨1/ I'm very excited to share a new working paper on the geography of telework titled "Working from Density," joint with Leah Brooks (@gwtrachtenberg) and @stanveuger (@AEIecon). (cc: @UCSDEcon)

5:26 PM · Jan 30, 2023

23 Reposts · 75 Likes

More papers

Thijs Bol@thijs_bol

Our new article (open access) shows that extremely rich people are not extremely smart. It plateaus around the 90th percentile, and wage differences at the top do not represent differences in cognitive ability.

(cc @elonmusk)

academic.oup.com/esr/advance-ar…

Marc Keuschnigg @MarcKeuschnigg

Extreme earners are not extremely smart 📣 https://t.co/MN29ofwjLF

Work with @arnoutvanderijt and @thijs_bol shows that the relationship btw ability & wage is strong but plateaus at high incomes:

⚡️Top wages are not indicative of top cognitive ability

8:19 AM · Feb 3, 2023

360 Reposts · 2.13K Likes

Stephan Seiler@SeilerStephan

🚨 Updated working paper 🚨

The Sequential Search Model: A Framework for Empirical Research (with Ella Honka & @ralucamursu).

tinyurl.com/ycx8sxur

By popular demand, the paper now comes with an accompanying code base: tinyurl.com/hhpjxeeh

tinyurl.com

seq_code.zip

5:17 PM · Jan 30, 2023

9 Reposts · 72 Likes

Tarun Chitra@tarunchitra

Out of the darkness of Q4 shines a bright question: Can crypto actually *improve* online trust via MEV auctions?

I believe crypto is the only way to implement credible auctions (unlike the DoJ's accusations against Google), but trust proofs not my word

eprint.iacr.org/2023/114

8:50 PM · Jan 30, 2023

45 Reposts · 214 Likes

Max Resnick@MaxResnick1

New paper alert🚨 🧵

@malleshpai, @eljhfx, and I investigate "Censorship Resistance in On-Chain Auctions"

11:46 PM · Jan 30, 2023

27 Reposts · 136 Likes

Rashad Ahmed@RashadA334

A new @IMFNews paper by @B_Eichengreen et al looks at recent trends in central bank purchases of gold and reports several interesting findings, including how geopolitical risk, sanctions,

and economic fundamentals influence demand for gold reserves

Link: imf.org/en/Publication…

12:48 PM · Jan 31, 2023

18 Likes

James Traina@EconTraina

I thought you needed price instruments to estimate demand… (@steventberry @PhilHaile)

… But you don't! (@_amackay @NateHMiller)

papers.ssrn.com

Estimating Models of Supply and Demand: Instruments and Covariance Restrictions

4:11 PM · Feb 3, 2023

27 Reposts · 132 Likes

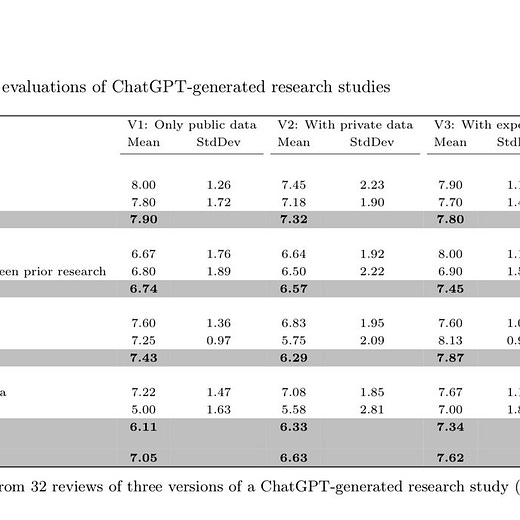

Ethan Mollick@emollick

New paper shows that ChatGPT is likely to impact academic research in big ways

The AI created short proposals for research papers in finance, which were peer-reviewed. All the AI papers had “a decent chance of eventual success in the reviewing process in a good finance journal”

2:20 AM · Feb 4, 2023

60 Reposts · 207 Likes