Best of #econtwitter - Week of December 6, 2020

Dec 07, 2020

Welcome readers old and new to this week’s edition of Best of Econtwitter. Thanks to those sharing suggestions, over email or on Twitter @just_economics.

Newsletters in recent weeks have been extra long: the quality of econtwitter seems to have gone up noticeably since the US election…

Paper summaries

Rachael Meager@economeager

Hello! Tamara Broderick, Ryan Giordano and I have a new working paper out!! It's called "An Automatic Finite-Sample Robustness Metric: Can Dropping a Little Data Change Conclusions?" arxiv.org/abs/2011.14999

5:42 PM · Dec 2, 2020

197 Reposts · 954 Likes

Rachael Meager@economeager

We propose a way to measure the dependence of research findings on the particular realisation of the sample. We find that several results from big papers in empirical micro can be overturned by dropping less than 1% of the data -- or even 1-10 points, even when samples are large.

5:43 PM · Dec 2, 2020

12 Reposts · 76 Likes

^a big deal? See also and see also

Alexander Berger@albrgr

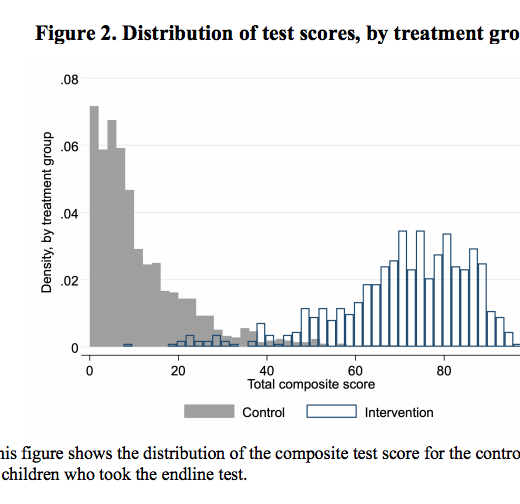

And then they had the biggest effects I can ever remember seeing in an education RCT: the distributions between treatment and control are basically disjoint. Treatment was ~5 SDs better than control but that's ~meaningless here because of how badly control does.

11:28 PM · Nov 29, 2020

17 Reposts · 105 Likes

^thread

Sylvain Catherine@sc_cath

🚨New working paper🚨 with Constantine Yannelis

We study “The Distributional Effects of Student Loan Forgiveness”. We find forgiveness to be a highly regressive policy. Full cancellation would distribute $192 bn to the top 20% of earners, and only $29 bn to the bottom 20%. 1/15

3:14 PM · Nov 30, 2020

625 Reposts · 2.04K Likes

Allison Shertzer@econhist_allday

There has been a lot of interest in “redlining” in economics recently. Here is a thread on my new paper with @econtrout, @JessicaLavoice, and Price Fishback on the construction of the HOLC maps, which hasn’t received a lot of attention in economics.

nber.org

Race, Risk, and the Emergence of Federal Redlining

3:00 PM · Nov 30, 2020

74 Reposts · 254 Likes

Alex Stamos@alexstamos

Really important work that, like most of the empirical evidence, strikes against the simplistic conventional wisdom of “algorithms” driving the information quality problem versus a more complex supply and demand issue.

Homa @homahmrd

Excited to share a new preprint "Evaluating the scale, growth, and origins of right-wing echo chambers on YouTube", with great @Amir_Ghasemian & @aaronclauset & @markusmobius & @DavMicRot & @duncanjwatts:

https://t.co/13ZBi9QRlB

Here’s a little summary: 1/10 https://t.co/q8p0u3ceHS

6:43 PM · Nov 28, 2020

35 Reposts · 113 Likes

Lauren H. Nicholas@lhnicholas

Elevated risk of credit payments 30+ delinquent isan early sign relative to those who never develop dementia (3/N)

4:27 PM · Nov 30, 2020

3 Reposts · 5 Likes

Douglas Irwin@D_A_Irwin

Thank you for the kind thread! Beat me to summarizing the paper...

Dr Anton Howes @antonhowes

New must-read paper from Maksym Chepeliev and @D_A_Irwin (one of world experts on 19thC free trade).

On the consequences of the repeal of the Corn Laws. Sounds like repealer propaganda was justified: bottom 90% gained, while wealthy landowners lost out.

https://t.co/0jK6P7Ovhm https://t.co/3l2TFbYKjf

12:09 PM · Nov 30, 2020

7 Reposts · 33 Likes

Robert Dur@DurRobert

A new stylized fact about CEO pay:

There is a big decline in the cross-sectional variation in CEO pay levels over the last decade, both on aggregate and within industry.

Interesting paper about the likely causes and consequences: papers.ssrn.com/sol3/papers.cf… by Torsten Jochem et al.

11:06 AM · Nov 30, 2020

10 Reposts · 32 Likes

Jason Abaluck@Jabaluck

Time for NBER Summer Institute live tweeting! Who will I antagonize this year? My guess based on program: people who want to keep their viable Kidneys even though they are dead.

5:58 PM · Dec 3, 2020

6 Reposts · 65 Likes

^thread on multiple health papers; see Abaluck’s account for additional threads

Tymon Słoczyński@TymonSloczynski

Most of my research is in econometrics but I have been lucky to also work on an amazing interdisciplinary project in economic history. A resulting paper on trade in ancient Greece has just been published in @EJ_RES. Below, I explain its contribution.

doi.org/10.1093/ej/uea…

1/n

3:11 PM · Dec 3, 2020

86 Reposts · 387 Likes

Ioana Marinescu@mioana

🚨Just published 🚨w. @RowenaGray6 & @nichiflu @ELSFinance. In the US, technology played a causal role in enabling workers to move away from agriculture and into manufacturing. Structural transformation is not just about rising incomes. t.author.email.elsevier.com/r/?id=ha43099f… 1/7

8:19 PM · Dec 3, 2020

7 Reposts · 40 Likes

Ugo Gentilini@Ugentilini

Do #cashtransfers make people happier?

@JoelMcGuire12 et al review 38 studies on wellbeing effects.

Findings?

- After 2 years, average cash effect is +0.10 standard deviations;

- More genrous provisions increase impact;

- Effect vanish after 7.5 years.

happierlivesinstitute.org/uploads/1/0/9/…

12:16 AM · Dec 4, 2020

30 Reposts · 99 Likes

Maya Eden@MayaREden

My paper "Welfare Analysis with Heterogeneous Risk Preferences" is in this issue of @JPolEcon!

journals.uchicago.edu/doi/10.1086/71…

Those of you who know me as a macroeconomist are probably looking at this and going: ?

So here is the story... A tale of writing outside of one's field

journals.uchicago.edu

8:58 PM · Dec 2, 2020

54 Reposts · 400 Likes

Zachary Liscow@ZLiscow

There is a huge amount of cross-state variation in the cost of building Interstate highways. The 75th percentile state spent $8.8 million more per mile than the 25th percentile state. The mean spending per mile of US Interstate miles is $11.5 million (2016 dollars). 3/N

3:49 PM · Dec 1, 2020

5 Likes

Carolin Pflueger@CarolinPflueger

My paper with @WenxinDu @JSchreger in @JofFinance: Governments that use inflation to devalue local currency debt, even if only in most dire states of the world, pay for it with higher bond risk premia. That's why these countries borrow in hard currency.

onlinelibrary.wiley.com/doi/10.1111/jo…

3:37 PM · Dec 5, 2020

34 Reposts · 219 Likes

Public goods

Tavneet Suri@SuriTavneet

Big, huge, awesome @vox_dev news today!!!

We are launching a new content type: VoxDevLits

"Research is a dynamic venture & standard literature reviews are static & often not updated for a decade... we wanted to try to create dynamic literature reviews"

voxdev.org

Launching VoxDevLits

4:37 PM · Nov 30, 2020

76 Reposts · 352 Likes

Nic Duquette@NicDuquette

★★★ Alert: (small) public good ★★★

After years of explaining to individual students how to create a complete workflow / replication archive for each project, I've created a template. It's available on Github here:

github.com/NicDuquette/Re…

1/

github.com

NicDuquette/Replication-Template

6:00 PM · Nov 30, 2020

24 Reposts · 93 Likes

Interesting discussions/threads

Matt Clancy@mattsclancy

Transition to a better system of article publication, peer review, and dissemination underway? Interesting thread.

Noah Haber @NoahHaber

It's happening...

As usual, eLife leads the way.

(h/t @deaneckles) https://t.co/CIBFl6U6Id

6:17 PM · Dec 1, 2020

3 Likes

John Horton@johnjhorton

What is the most underrated Econ PhD program? E.g., it consistently produces well-trained graduates but is often overlooked for some reason? Like if you were trying to moneyball junior hiring, where would you look?

10:42 PM · Dec 1, 2020

7 Reposts · 86 Likes

^followup: what’s the most underrated journal?

Chris Blattman@cblatts

it’s great that economists do lots of field work and interviews now. But think of the absolute sloppiest, terrible causal inference paper you can remember, from someone who doesn’t even know that they don’t know what they’re doing.

That’s how economists do qualitative research.

Matt Darling 🌐💸🌇 @besttrousers

@AlexBartik @D_Kuehn @cblatts That's exactly right (and also discussed in Duflo's economics as plumbing essay).

I find it so weird that folks treat qualitative and RCT work as if they are on opposite ends of a spectrum.

2:05 PM · Dec 4, 2020

45 Reposts · 295 Likes

Per Engzell@pengzell

In replicating an analysis, it is possible to “p-hack” your way to overturning the original results. Any good papers discussing this?

2:20 PM · Dec 1, 2020

11 Reposts · 99 Likes

Job market papers

Arindrajit Dube@arindube

This is a very interesting paper that overturns several pieces conventional wisdom due to the workings of a dynamic monopsony model: namely on-the-job search and wage posting.

Increasing wage flexibility for new workers could WORSEN unemployment fluctuations.

Marginal Revolution @MargRev

Wage stickiness for incumbents vs. new workers https://t.co/g5jfBH8OBv

9:55 PM · Dec 2, 2020

31 Reposts · 183 Likes

Vladimir Smirnyagin@v_smirnyagin

🚨How do business cycle fluctuations affect firm formation?🚨

My revised JMP argues: very large firms do not start in downturns. I combine US Census data with a model to document & study this compositional effect. Summary 🧵: 1/N

#EconTwitter

Paper: dropbox.com/s/imrozvyf3su6…

6:21 PM · Nov 29, 2020

20 Reposts · 109 Likes

Kilian Rieder@kilian_rieder

My #JMP is now available as an @ESRB working paper!

“Financial Stability Policies and Bank Lending: Quasi-experimental Evidence from Federal Reserve Interventions in 1920-21”

Link to paper (incl. appendix):

tinyurl.com/yyku8ly7

#EconTwitter #econhis

Thread

1/8

tinyurl.com

12:25 PM · Dec 1, 2020

4 Reposts · 3 Likes

Andrei Munteanu@andrei_mntn

*jm thread warning* Hello, #EconTwitter! I am a 2020-2021 JMC in economics from @mcgillu, specializing in the economics of education. In my JMP, I study how student sorting along ability affects their educational performance and through which channels.

drive.google.com

Andrei Munteanu - JMP.pdf

8:54 PM · Dec 1, 2020

11 Reposts · 41 Likes