Welcome readers old and new to this week’s edition of Best of Econtwitter. Please submit suggestions — very much including your own work! — over email or on Twitter @just_economics.

Idiosyncratic favorites

I posted this striking chart from Yongseok Shin that underscores how much employment by sector has not returned to pre-pandemic patterns. I got lots of questions. Some answers. A thread. #BPEA @BrookingsInst

^see also (though not a paper):

This is interesting. The goods share of spending is stagnating a bit, rather than reverting back to pre pandemic levels.

In turn, this is maybe contributing to ongoing demand and hence inflationary pressures on goods vs services.

Council of Economic Advisers @WhiteHouseCEA

Nominal growth in services spending outpaced growth in goods spending. Therefore, the services share of consumption rose slightly in February. The goods share still remains substantially elevated relative to pre-pandemic norms. 6/

Paper summaries

Did you know that financial constraints by ethnicity can contribute to disparities in wealth and access to geographic opportunities?

@arpitrage, @ChrisHansman, and @pgmabille uncover a racial leverage gap in new work: Black borrowers are given higher loan-to-value ratios.

Excited to share that our research on the pink tax has been accepted for publication at Marketing Science! See @jasonfurman’s nice thread on our findings and you can check out the full paper here:

papers.ssrn.com/sol3/papers.cf…

Jason Furman @jasonfurman

Very happy that "The Political Economy of Status Competition: Sumptuary Laws in Preindustrial Europe" w @desireedesierto has been accepted at the Journal of Economic History.

"Dynamic Spatial General Equilibrium" in Econometrica is what it sounds like: integrating forward-looking capital accumulation into a dynamic discrete choice model...of migration.

Let's go: onlinelibrary.wiley.com/doi/10.3982/EC…

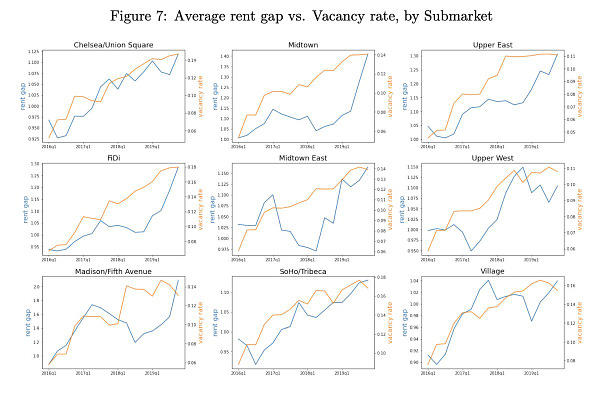

A full draft now of the paper by Dan Stackman and Erica Moszkowski on downward nominal rigidity in retail leases.

Vacancy and rents are *positively* correlated in Manhattan. Their story: debt covenants restrict rent reductions. @jeffrlin

dstackman.github.io/files/stackman…

Publication alert! 🥳

Very happy that our paper on “Strategic Competition and Self-Confidence” with Stefanie Brilon, @SimonaGrassi and @Jfschulz has found a home and is forthcoming at Management Science (@INFORMS)

pubsonline.informs.org/doi/abs/10.128…

1/n

Most people in most countries think climate change is a problem, understand what causes it, and want to tackle it. Awareness is *not* any longer the main barrier to climate action. Important work by @S_Stantcheva & coauthors at #EfIP conference today

Using data from @usociety, we show that the #IceBucketChallenge increased the prob of donating and the amount of money donated among small donors.

We also find an effect on #volunteering and #trust, suggesting that such campaigns might have a broader impact on prosocial behavior

More paper summaries

Yesterday I presented some of my thesis research at #EHS2023 – here is a *very* brief overview of some of the things I said:

We have used bank-transaction data of 930.000 Belgian households (almost 20% of the population) to examine the evolution of energy expenditures. The results are striking… given that Belgium has a system of automatic wage indexation. A thread 1/n

Another study, this time at BPEA, finding the IRA's green credits could cost $1.2 trillion between now and 2031 or up to $2 trillion through 2040. Well above the advertised cost of ~$400 billion. So IRA will go down as a large deficit expansion bill

brookings.edu/wp-content/upl…

^Matt Yglesias: “Some people see this as a bad thing, but the news that the IRA may induce much more clean energy than forecasted by the CBO is actually good”

"War and Nationalism: How WW1 Battle Deaths Fueled Civilians’ Support for the Nazi Party"

cambridge.org/core/journals/…

I've been rather inactive on here lately and have so many new results to share! I'll try to slowly get caught up.

First, a new graph! 1/n

My paper with @soashworth and Chris Berry on "Modeling Theories of Women's Underrepresentation" is now available on Early View @AJPSEditor.

onlinelibrary.wiley.com/doi/full/10.11…

1/

🚨 🚨 New paper alert 🚨 🚨

Joint work with @gokhanider @FrederikKurcz @schumann_b

Can the ECB fight high energy prices?

Yes, they can!

There even is an energy-price channel of (European) monetary policy

A short 🧵with the highlights: 1/6

Factory farming might be the world’s largest negative externality. Kuruc and McFadden (2023) make an attempt to “monetize the externalities of animal agriculture,” accounting for its direct effects on animal welfare. I wanna apply their method to eggs 1/

Englander et al. (2023) have an interesting new paper about China’s fuel subsidy for its fishing fleet, trying to find out how much additional subsidies affect hours spent fishing, as well as whether fishing occurs at all. A thread! 1/

Basu (2005) argued that an imperfectly enforced child labor ban (which fines firms for hiring children, say) might end up increasing child labor, and some recent empirical research seems to back his argument 1/

sciencedirect.com/science/articl…

The economics of Japanese toilets simplified

https://hiddenjapan.substack.com/p/japanese-idiosyncrasies-and-the-galapagos