Best of #econtwitter - Unrealized capital gains taxation, special supplement

A Harris proposal on capital gains taxation sparked some good discussion on the economics. The crux of the matter is the proposal to tax unrealized capital gains in some way (whereas capital gains are currently only taxed at realization).

Unfortunately I don’t have a reference on what “the current proposal” is… but here are some tweets:

There was also a now-deleted excellent Dylan Matthews thread (his tweets delete automatically after a few weeks) that had some overlap with Steven Hamilton’s thread. This was followed by some good commentary from Tyler Cowen

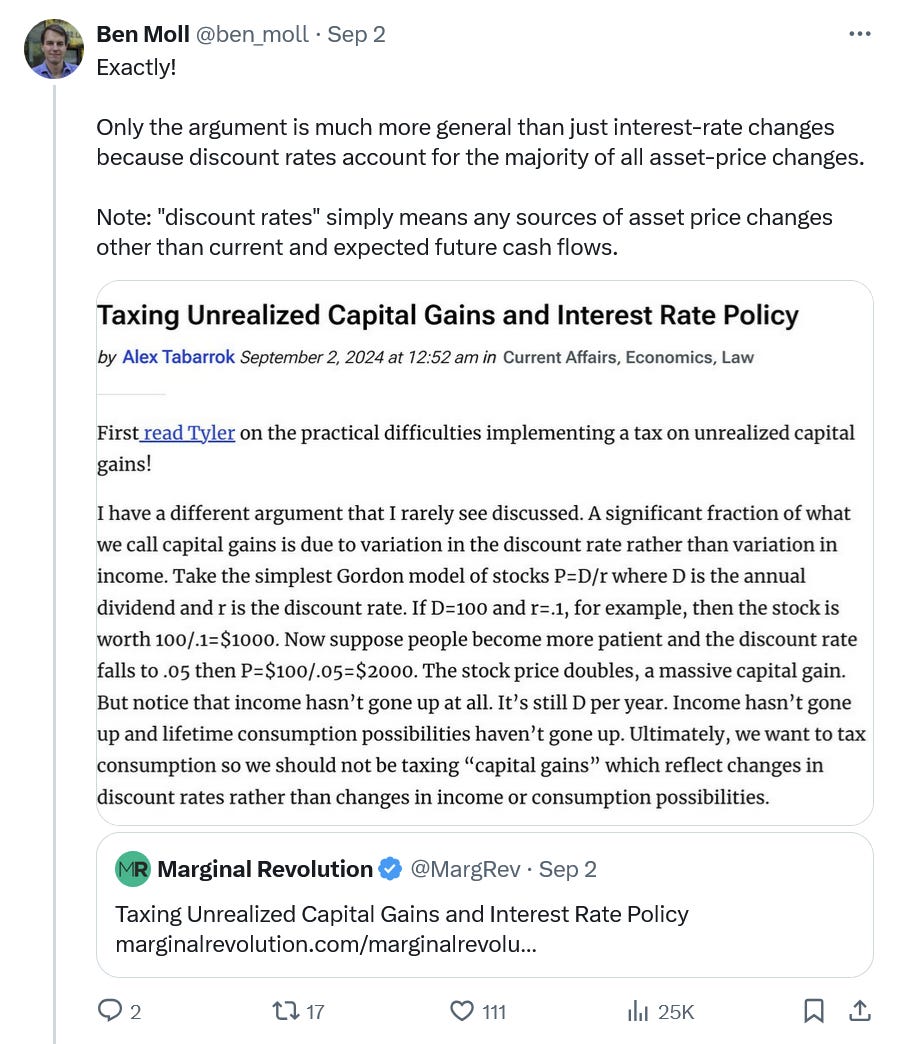

and this good piece from Alex Tabarrok, who makes points echoed in a recent Aguiar, Moll, and Scheuer paper:

^the full thread on their paper is here. For some additional intuition you can think about bond prices:

Here’s productive Furman and Moll discussion on this point:

and here’s the argument in meme form, and a bit more from Moll in a thread there too.

Here’s Furman again:

^IMO the platonic ideal is: tax unimproved land and negative externalities alone and forget about everything else if possible [this is just friendly sass]. Anyway:

^the thread continues, it is also good; Tyler Cowen has another interesting post here. Finally, related to the above tweet, a lot of discussion on this tweet:

Zooming out

Zooming further out:

^to emphasize, even if you prefer to abolish capital taxation a la Chamley-Judd, as Furman above emphasizes you can have a second-best discussion on the de/merits of taxing unrealized capital gains relative to the status quo.

On the broader question of capital taxation: strongly recommend this brilliant old Steve Randy Waldman post on “K is not capital, L is not labor” — the insight of which was, actually, formalized in a Jones, Manuelli, and Rossi (1997) JET paper. I would still summarize the literature (yes, including Straub-Werning) as showing that taxing capital is undesirable.

Zooming even further out — we’re getting close to galaxy brain territory —